The stock prices of the country’s two largest publicly traded companies that own and manage prisons and immigrant detention centers soared immediately following Donald Trump’s election as president. Shares in GEO Group and CoreCivic rose again the day after the president-elect announced Tom Homan, who managed immigration enforcement during Trump’s first administration, as his “border czar.” Speaking at the Republican National Convention this summer, Homan said, “I got a message to the millions of illegal aliens that Joe Biden’s released in our country. You better start packing now.”

This is not the first time prison company stocks skyrocketed at the news that Trump would take the Oval Office. When he was elected in 2016, the private prison industry — which analysts had referred to as beleaguered — immediately rebounded. Two weeks later, CNBC reported that an analyst had written in a research note, “The Trump victory was a game changer for these stocks.”

That this is a repeat phenomenon should come as no surprise. Echoing the rhetoric from his first campaign, Trump spent much of his time on the campaign trail over the past few years promising to undertake “the largest deportation operation in the history of our country.” Clearly, the incoming administration’s focus on immigration enforcement provided the confidence investors needed to bet on these stocks, which profit from government contracts for prisons and detention centers.

Two key players in the industry are especially well positioned to thrive under a second Trump term. GEO Group noted in its recent annual report that U.S. Immigration and Customs Enforcement contracts accounts for 43 percent of its revenues. CoreCivic reports that 30 percent of its revenue came from ICE contracts in its most recent annual report. These companies seem well aware that greater gains lie ahead. As GEO Group Executive Chairman George Zoley said on an earnings call on November 7, “The GEO Group was built for this unique moment in our . . . country’s history and the opportunities that it will bring.”

One less obvious but still important benefit is that GEO Group’s and CoreCivic’s transportation subsidiaries are also likely to secure more contracts with the federal government if large-scale deportation efforts move forward. Generally speaking, deportation isn’t an immediate process — many people navigating the vast U.S. immigration infrastructure will need to be transported between facilities and to court hearings.GEO Group’s CEO acknowledged the potential of their transport services on the earnings call, noting, “We believe we have the capabilities to expand the provision of these services to assist ICE in moving several hundreds of thousands of additional individuals if needed.”

Other aspects of the Trump administration’s proposed law enforcement agenda could similarly drive profits for private prison companies. When it comes to “law and order,” Trump’s campaign platform declares that his administration will “increase penalties for assaults on law enforcement, put violent offenders and career criminals behind bars, and surge federal prosecutors and the National Guard into high-crime communities.” Currently, the Department of Justice can’t legally contract directly with for-profit firms to house people awaiting trial or convicted of crimes. But that is most probably about to change.

Recent presidents have followed a pattern of undoing their predecessors’ policies on the DOJ’s for-profit prison contracts. In August 2016, under President Barack Obama, then–Deputy Attorney General Sally Yates sent a memo to the Bureau of Prisons directing it to decline to renew contracts with for-profit firms. Six months later, then-President Trump’s attorney general rescinded the Obama administration’s memo and instructed the Bureau of Prisons to resume contracting with for-profit firms. Then in January 2021, within President Biden’s first days in the White House, he issued an executive order directing the attorney general not to renew DOJ contracts with privately operated criminal detention facilities. Biden’s order took the Obama-era policy a step further by applying it to contracts with not just the Bureau of Prisons but also the U.S. Marshals Service, both of which are within the Justice Department.

We should expect whiplash again, as it is almost certain that President-elect Trump will tear up the existing executive order that resulted in the successful terminationof all for-profit contracts at the Bureau of Prisons and many at the Marshals Service.

Beyond merely housing and transporting people who are undocumented, private prison corporations are also poised to profit from supervising undocumented people living in the community. For example, GEO Group’s subsidiary BI Incorporated currently has a contract with ICE for the case management and supervision services that are part of the federal government’s Intensive Supervision and Appearance Program. This often involves phone reporting, GPS monitoring, and surveillance through SmartLINK (which uses facial recognition and other technologies).

On Geo Group’s earnings call, the chief operating officer said, “We expect the incoming Trump administration to take a much more expansive approach to monitoring the several millions of individuals who are currently on the non-detained immigrant docket.” On the same call, the company’s executive chairman explained that when it comes to the Intensive Supervision and Appearance Program, they can “scale up from the present 182,500 participants to several hundreds of thousands or even millions of participants.”

It appears that CoreCivic doesn’t have a contract for this service at the moment, but that could change in the next four years as GEO’s current contract is set to expire in May 2025.

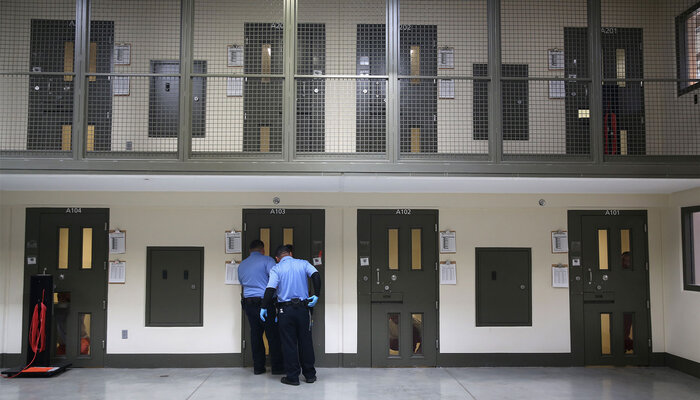

The latest private prison industry stock boom makes clear the sobering reality I discussed in my book, Inside Private Prisons: The mass detention of undocumented individuals is inextricably intertwined with the growth of companies that profit from prisons and detention. To be clear, these corporations are not directly responsible for the country’s immigration policies. From a business perspective, the private prison industry’s services meet a desperate governmental need to find bed space for the increasing number of people the government seeks to detain. The federal government has increasingly outsourced this function to corporations, with more than 90 percent of individuals in immigrant detention housed in facilities owned or managed by for-profit entities as of 2023.

But as many advocates and policymakers have noted over the past few decades, the business model for these for-profit prison firms allows for wild upswings in detention by offering the government vast capacity. So, as we stand on the precipice of an explosion of mass detention, it is critical to acknowledge that if these corporations didn’t exist, it would be difficult for the federal government to execute its plans.